This week we continue our theme of community bank stocks. The Financial Services sector and the banking industry are still the worst performing stock in 2023. High-interest rates have affected their business. Also, many investors are staying away because of the collapse of Silicon Valley Bank, Signature Bank, and Silvergate.

The Bank of Marin Bancorp is another small community bank. It was founded in 1989 and reorganized into a bank holding company in 2007, providing personal and commercial banking in Northern California. The bank has 31 retail branches and eight commercial banking centers in ten counties. The market capitalization is only ~$326 million.

According to Stock Rover*, the stock price is down approximately (-37.4%)this year and (-35.1%) in the trailing year after adjusting for dividends reinvested. For perspective, the S&P 500 Index has fallen only (-5.4%) in the past twelve months but is up +8.2% in 2023. Hence, the Bank of Marin is in a bear market.

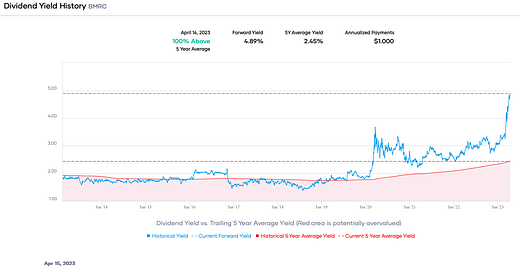

The Bank of Marin is a Dividend Contender with 18 straight years of dividend growth. The stock price plunge has resulted in the dividend yield rising to ~4.9%. This value is the highest in a decade and more than 2% percentage points over the 5-year average. The payout ratio is conservative at about 33%. Additionally, the bank has increased the dividend by roughly 12% annually, but growth is slowing.

Source: Portfolio Insight*

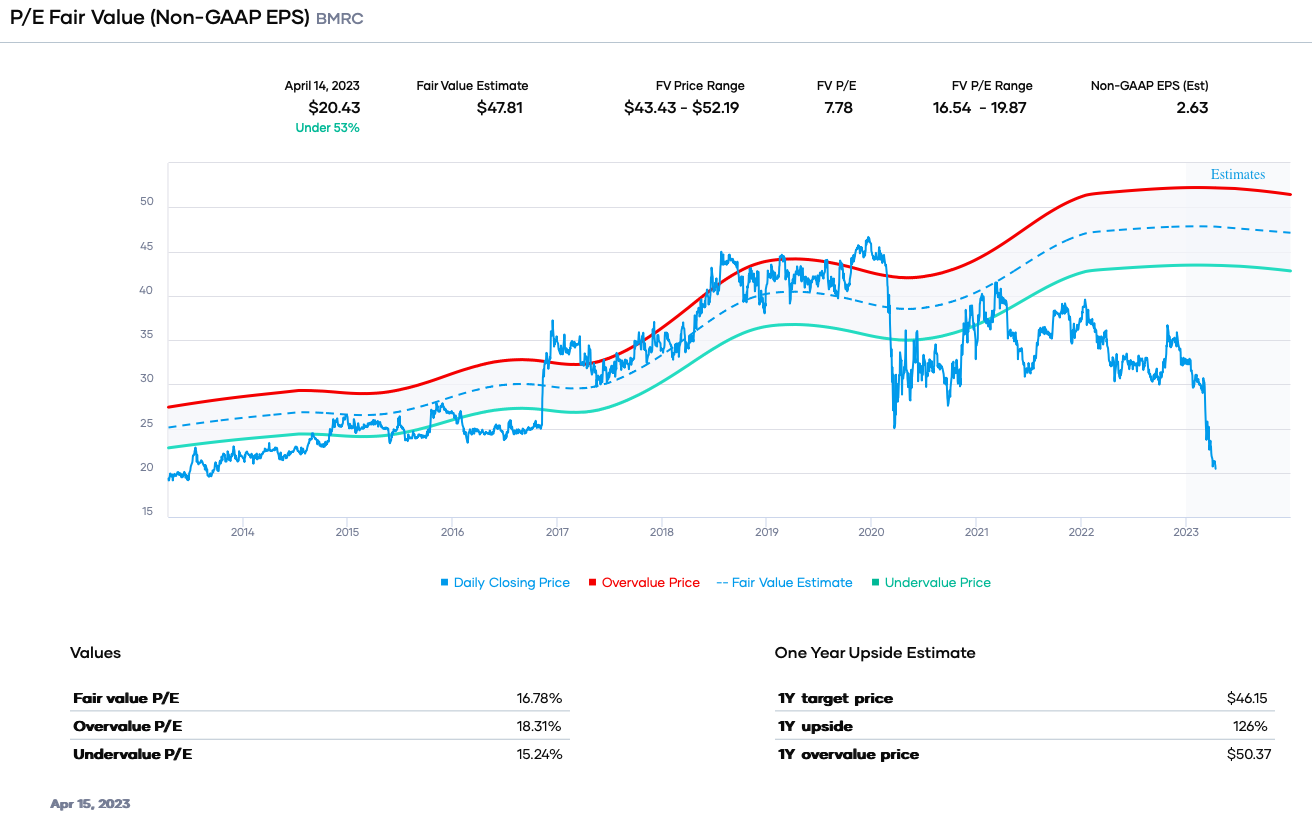

The Bank of Marin is trading well below its historical P/E ratio range. The bank is trading at a forward P/E ratio of around 7.8X. This value is significantly below the ranges in the past five and ten years. Consequently, investors should take a more extended look at this stock.

Source: Portfolio Insight*

Disclosure: None

Disclaimer: The author is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.