I also wrote about Lowe's (LOW) at the end of 2022. The share price has gone almost nowhere in the following four months. However, the stocks are still undervalued, the dividend yield is higher than the 5-year average, and the dividend growth rate is double-digit. Investors should consider this stock.

The home improvement retailer was established in 1921. Lowe's has grown into America's second-largest home improvement retailer, behind the market leader, Home Depot (HD). The company has over 2,200 stores in North America. Lowe's sells leading national and private-label brands. The private-label brands are owned by Lowe's. They include Allen + Roth, Kobalt, Harbor Breeze, Holiday Living, Stainmaster, Moxie, and Origin21.

Total revenue was around $97,059 million in the fiscal year 2022 and the last twelve months.

Lowe’s stock price has started to recover from its 52-week bottom last year. According to Stock Rover*, the stock price is up 6.5% in 2023 and +2.8% in the trailing year after adjusting for dividends return. For perspective, the S&P 500 Index has been down (-5.7%) in the past twelve months.

Moreover, the forward dividend yield is still at roughly 2.0%. This value is greater than the average yield for the S&P 500 Index of 1.65%. The 5-year average is also lower at 1.73%. Lowe's has a long history of dividend increases at 61 years, making the stock one of the 42 Dividend Kings. The payout ratio is conservative at only ~27%. In addition, the dividend quality grade is high at an ‘A+.’

Source: Portfolio Insight*

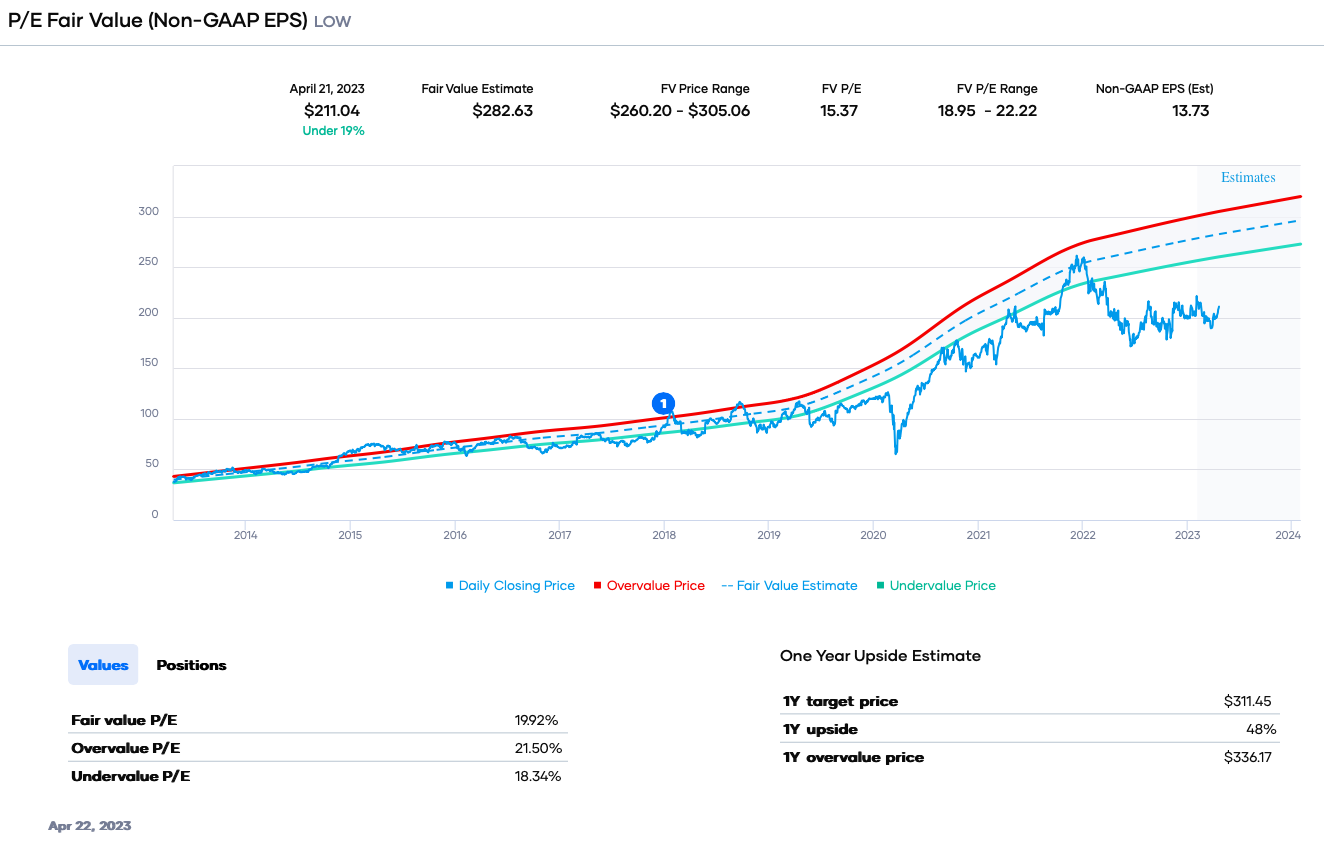

Lowe’s is undervalued based on the historical price-to-earnings (P/E) ratio. It trades at a multiple of about 15.4X, below the 10-year range. Lowe's is attractive to investors because of its dividend history and market leadership. Investors should look at this stock now.

Source: Portfolio Insight*

Disclosure: Long LOW

Disclaimer: The author is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.