Stock Market This Week - 05/05/23

Stock Market This Week

Stock Market This Week – 05/05/23

Another bank failed this past week. Government regulators seized First Residential (FRC), and JP Morgan Chase (JPM) bought most of its assets for $10.6 billion. The market dropped in response as fears of broader banking contagion accelerated selling.

Adding injury to insult, the U.S. Federal Reserve increased the Federal Funds rate by another 0.25%, reaching a target range of 5% to 5.25%. The Fed Chair indicated a pause may be in the works after the latest increase. However, short-term U.S. Treasury yields are over 5% and a great deal. As a result, investors can park cash for a few months and earn the highest interest rate in a decade, essentially risk-free. That said, the debt ceiling battle adds risk to the U.S. economy.

But good earnings from Apple (AAPL) and another excellent job report caused buyers to come out of hiding on Friday. Despite recession fears, job growth is robust, and the unemployment rate is 3.4%, tied for the lowest on record. The United States may still experience a recession, but we are skirting it for now. However, slowing Gross Domestic Product (GDP) and manufacturing data may push the U.S. into a recession.

Stock Market Overview

The stock market had a mixed week.

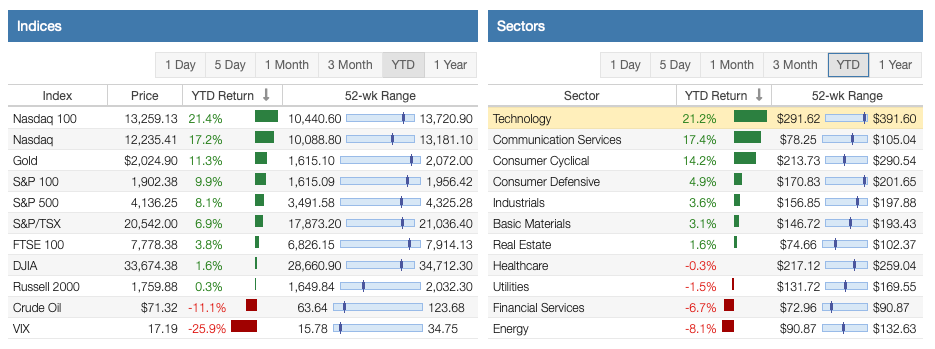

As shown by data from Stock Rover*, the Nasdaq finished up, but the Russell 2000, the S&P 500 Index, and the Dow Jones Industrial Average (DJIA) declined for the week.

Four of the 11 sectors had positive returns for the week. Technology, Healthcare, and Industrials were the top three sectors for the week. But the Consumer Services, Financial Services, and Energy sectors performed worst.

Oil prices plunged 7.1% to $71 per barrel. The VIX rose and is still near its long-term average. Gold traded moved upward to above $2,000 per ounce.

Source: Stock Rover*

The Nasdaq is performing the best for the year, followed by the S&P 500 Index, the Dow 30, and the Russell 2000. In addition, 7 of the 11 sectors are up year-to-date. The three best-performing sectors are Technology, Communication Services, and Consumer Cyclical. Conversely, the worst-performing sectors are Utilities, Financial Services, and Energy.

Source: Stock Rover*

The dividend growth investing strategy has put in mixed returns as banks and energy stocks declined but are bouncing back. The table below shows their performance by category. Three of the four categories are in positive territory.

Category [YTD Return (%)]

Dividend Kings +1.1%

Dividend Aristocrats +3.4%

Dividend Champions (-1.1%)

Dividend Contenders +7.0%

Dividend Challengers (-4.7%)

Source: Dividend Power

Disclaimer: The author is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.